We’ve seen a lot of changes in the Black banking sector of late. With the announcement that a Black-led investor group plans to acquire Holladay Bank & Trust in Holladay, Utah, the proposed creation of a credit union by Alpha Kappa Alpha, the nation’s oldest Black sorority, the public debut of a Black-owned bank (Adelphi Bank) in Columbus, Ohio, and the unconfirmed identification of two new Black banks (Tioga-Franklin Savings Bank in Philadelphia, PA, and Grand Bank for Savings, FSB, in Hattiesburg, Mississippi), activity in the Black banking sector has increased dramatically.

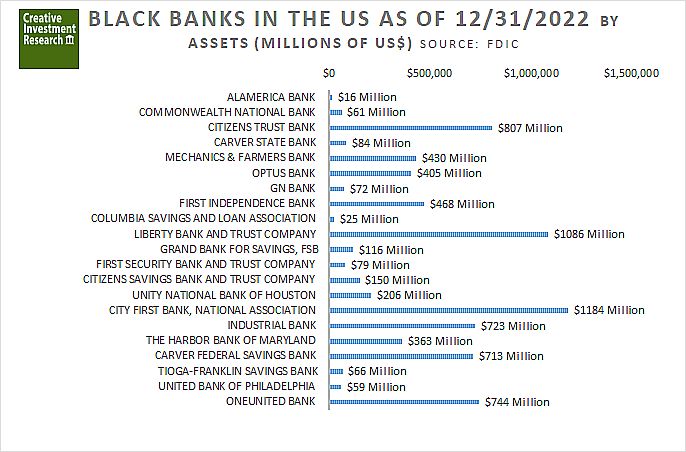

This recent growth may be the result of increased funding for Black banks following the $71 billion corporations pledged for Black Lives Matter following the George Floyd incident. Longer term, even if we confirm the African American ownership of Tioga-Franklin and of Grand Bank for Savings, there are still only 21 Black banks, representing 4 tenths of one percent of 4,706 total commercial banks and savings banks in the US as of 12/2022, according to the Federal Deposit Insurance Corporation (FDIC).

Despite these developments, as I noted in 2019, banking regulators have a history of neglecting the banking needs of the Black community, and by extension, the country. Even now, black banks remain too small and too weak to have a significant economic impact.

Given recent activity, I still think it viable for the Federal Open Market Committee (FOMC) of the Federal Reserve Board to purchase mortgage-backed securities (MBS) originated by black banks as part of open market operations. I first suggested this in 1994 at the Federal Reserve Bank of Kansas City. Since the 2006 financial crisis and 2020 pandemic, the Fed has purchased trillions in securities, helping white-owned banks, broker-dealers, insurance companies auto companies, and investment banks survive.

The solution to the Black banking impact crisis is to have the Fed, via the FOMC, create a Black bank liquidity pool totaling at least $50 billion. The pool’s focus should remain on purchasing Treasury, MBS securities and Small Business Administration (SBA) loan pools from Black ownership verified banks. To administer this new effort, I suggest having the Commerce Department’s Minority Business Development Agency help the Fed make loans to Black banks instead of simply making short and intermediate term loans to large non-minority banks, as is currently the practice of the FOMC. This would provide an estimated $450 to $500 billion dollar boost, positively impacting both the Black community and the US economy.