As the 2024 election season heats up, economic policy proposals are once again at the forefront of the national debate. Vice President Kamala Harris, widely recognized for her work in the Senate and in the White House, has introduced a comprehensive economic strategy known as “Kamalanomics,” built on principles of inclusive growth, social equity and targeted investments in underserved communities. READ MORE.

MinorityBank Blog

UnivNoCar TO PAY $4.8M TO ANTI-AFFIRMATIVE ACTION ACTIVIST

The case revolves around Students for Fair Admissions, which received a $4.8 million settlement from the University of North Carolina (UNC) following a Supreme Court ruling against race-conscious admission programs. Blum’s pursuit of legal fees post-ruling, alongside concerns about the financial impact on educational institutions and potential deterrents to diversity initiatives, could be seen as indicative of a primarily financial motivation for these lawsuits. For more information, you can read the article here: https://www.blackenterprise.com/unc-agrees-pay-group-anti-affirmative-action-activist-4-8m/

Racial Disadvantage and Government Aid

In a recent article, the Washington Post presented a contentious view on the role of federal programs in addressing racial inequality. The paper indicated these programs are based on flawed assumptions of inherent disadvantage, but this overlooks the nuanced complexities of systemic barriers faced by minority groups. What is needed is a more honest, ethical, balanced perspective, highlighting the historical context and the necessity of such programs.

Contrary to the Post’s assertion, federal aid programs for minority businesses are not premised on an inherent disadvantage but rather on a history of systemic barriers. Evidence from numerous studies points to the continued challenges minority-owned businesses face in accessing capital and opportunities, a disparity these programs aim to address.

Legal challenges to these programs simplify a complex issue. A more nuanced discussion is needed, one that acknowledges the successes and pitfalls of these efforts while striving for equitable solutions.

The categorization of disadvantaged groups in federal programs is not a haphazard process. Decades of research, including my book “Thriving As a Minority-Owned Business in Corporate America: Building a Pathway to Success for Minority Entrepreneurs 1st ed.” have meticulously documented an evolving understanding of racial dynamics and economic inequalities as evidenced by the data.

The Minority Business Development Agency (MBDA) plays a crucial role in supporting minority businesses. Statistics on the agency’s impact challenge the notion that its focus is solely on racial categories, highlighting its significant economic contributions.

The article errs in linking the Supreme Court’s education ruling to business and government contracting, since this overlooks the fact that these are independent legal areas. There are unique challenges and requirements in these sectors. A distinction is necessary for a fair analysis. The affirmative action ruling is simply not applicable to minority contracting.

An in-depth examination of the plaintiffs’ arguments reveals a shallow, inaccurate understanding of complex legal and ethical considerations. The broader implications of these cases on societal equity warrant careful consideration.

A balanced approach is needed, one that recognizes the necessity of race-based programs while also acknowledging their limitations. Constructive suggestions for improvement include increased transparency, regular program evaluations, and inclusive dialogues to refine these initiatives.

In conclusion, while it’s essential to critique and improve government programs, dismissing them outright fails to recognize the systemic challenges they aim to address. A better approach is to engage in a more informed and constructive dialogue, seeking solutions that balance societal equity with fairness and equality. Let’s strive for a future where government aid is both effective and inclusive, fostering a business landscape that truly reflects the diversity and potential of our society.

SBA LENDING TO BLACK BUSINESSES DOUBLES

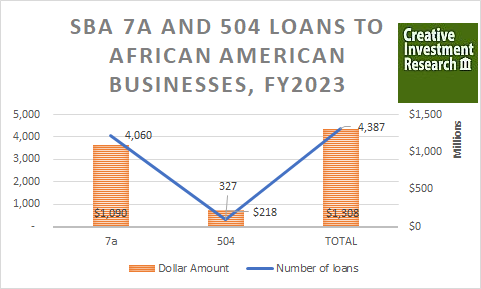

Calling it “historic progress,” the U.S. Small Business Administration announced it has doubled lending to Black businesses nationwide in multiple categories.

The SBA on Thursday, Sept. 21, reported it has backed 4,387 loans to Black-owned businesses so far in fiscal 2023 via its 7(a) and 504 loan programs, over twice as many as since 2020. In terms of loan amounts, a total of $1.3 billion has been provided, constituting a 7.5% overall share of SBA-approved loans for businesses, also showcasing a doubling since 2020.

The SBA reported that women and people of color have led a historic small business boom. Some 13.1 million new business applications have been filed with the agency since President Joe Biden took office— a rate 65% faster than the pre-pandemic average.

SBA Administrator Isabel Casillas Guzman and Congressman Steven Horsford (D–NV Fourth District) announced the loan performance at the 2023 Congressional Black Caucus Foundation’s Annual Legislative Conference on Thursday.

“Black businesses are helping to power a nationwide small business boom that is creating jobs, advancing equity in communities across America, and uplifting our economy,” Guzman stated.

She added, “Today’s benchmark loan numbers show our work under President Biden’s Investing in America agenda making inroads to support more of America’s Black small business owners. Despite these gains, we still have a long way to go. We continue to push forward with long overdue and transformational reforms to our lending and investment programs that will raise the bar of equity and opportunity even further for all of America’s small businesses.”

“Economic mobility and success are vital to achieving the American dream, but for far too long small businesses owned by Black Americans have faced roadblock after roadblock on that path,” said Horsord, the chairman of the Congressional Black Caucus.

A separate analysis of SBA data is projecting that Black businesses in America could obtain at least another $200 million in loans by the end of 2023 if that activity continues at its current pace.

According to a calculated analysis by Creative Investment Research, the extra money could come from the SBA’s 7(a) and 504 loan programs. The Washington, D.C.-based firm projected in June 2023 that lending to Black firms would rise to $1 billion this year, up from nearly $600 million in 2017. Black businesses widely use both programs.

Creative Investment Research reports the target for 2023 was reached this month as (7a) lending to Black firms totaled over $1.09 billion.

The cash infusion could be vital as securing financing is often among the largest operating challenges for Black entrepreneurs. The SBA loans can be used in many ways, including working capital, buying land, and acquiring equipment. The money can be tapped for acquisitions, expansion, and other uses.

William Michael Cunningham, economist and owner of Creative Investment Research, told BLACK ENTERPRISE that from his company’s analysis, the SBA in 2023 approved 4,060 7(a) loans for Black firms, representing nearly 8% of total loan approvals. He says the $1.09 billion in total dollars granted to Black businesses represented 4.5% of overall lending activity in that category.

Now, Cunningham’s firm projects lending activity to keep growing.

“We now anticipate total SBA (7a) lending to Black firms will reach $1.2 billion in 2023,” he said.

However, SBA lending directed to Black businesses still has a way to go compared to other demographics. For instance, the data tied to the 2023 SBA 7(a) loan approval amount showed over $4.6 billion for Asian businesses and roughly $10.3 billion for white companies.

Cunningham says the gap in lending between the groups is significant but represents an opportunity for collaboration to make more loans to underrepresented communities. He says the Minority Business Development Agency might serve as the focal point for this proposed collaborative effort.

The SBA’s support for Black-owned businesses has been steadily rising over time. Cunningham says the number of 7a loans to Black firms approved has grown 68% when comparing 2023 to 2017.

Further, Cunningham says the SBA has worked more with Black-owned banks to expand access to 7(a) loans. He provided this chart on institutions’ contributions to Black businesses this year pertaining to SBA (7a) loans:

- Lendistry SBLC, LLC (California) approved 83 loans worth just over $47 million.

- Mechanics & Farmers Bank (North Carolina) approved 7 loans totaling over $4.9 million.

- Industrial Bank (Washington, D.C.) approved 2 loans for over $1,6 million.

- Tioga-Franklin Savings Bank (Pennsylvania) approved 4 loans totaling $1,2 million.

- The Harbor Bank of Maryland (Maryland) approved 1 loan worth $558,000.

- Liberty Bank and Trust Company (Louisiana) approved 3 loans totaling $299,000.

- The First Security Bank (Oklahoma) approved 1 loan for $160,000.

Mechanics & Farmers Bank, Industrial Bank, The Harbor Bank of Maryland, and Liberty Bank and Trust are listed on the BE Banks list of the nation’s largest Black-owned banks.

From: Black Enterprise Magazine. 9/23/2023. See: https://www.blackenterprise.com/sba-black-business-loans-doubled/

Black America Should Apply for Membership in BRICS

In a world that constantly evolves and redefines the dynamics of power and influence, the time has come for African Americans to explore innovative avenues that can bolster their collective progress. One such opportunity lies in seeking membership within the BRICS alliance – a coalition of emerging economies that has reshaped global diplomacy and economic dynamics. By advocating for African American inclusion in BRICS, we can pave the way for enhanced socio-economic empowerment, representation, and collaboration on an international scale.

BRICS, comprised of Brazil, Russia, India, China, and South Africa, represents a formidable force in the global arena. This group brings together nations that share common challenges and aspirations, including a desire to break free from historical patterns of cultural dominance. The potential benefits for African Americans to engage with BRICS are significant and multifaceted:

- Economic Empowerment: The BRICS economies contribute significantly to the global GDP and trade. By aligning with these nations, African Americans farmers, for example, might be able to tap into vast markets. This effort might also result in significant investments, and technology transfers that foster economic growth and entrepreneurship within the Black community.

- Political Representation: Joining BRICS would offer African Americans a platform to raise their voices on global matters, contributing to policy decisions that address racial equality, social justice, and human rights not just domestically, but across the world.

- Cultural Exchange: Membership in BRICS would facilitate cultural exchange, providing African Americans with the opportunity to share their rich heritage while learning from the cultures of other member nations. This cultural exchange could foster mutual understanding and respect.

- Education and Innovation: BRICS members are known for their advancements in science, technology, and innovation. Collaboration with these nations could result in knowledge transfer, research partnerships, and educational opportunities that benefit African American communities.

- Diversified Alliances: Engaging with BRICS would help African Americans diversify their diplomatic and economic partnerships beyond traditional Western allies, creating a more balanced and strategic approach to international relations.

Challenges and Opportunities:

It’s important to acknowledge the challenges that may arise from pursuing BRICS membership. Geographical and political complexities, as well as alignment with member nations’ goals, would need careful consideration. However, history teaches us that transformative change often requires the courage to explore, without seeking to colonize, uncharted territories. By advocating for BRICS membership, African Americans can expand their global influence and contribute to reshaping international norms.

Steps Forward:

- Awareness and Mobilization: African American leaders, scholars, and influencers must raise awareness about the potential benefits of joining BRICS, sparking conversations within the community and beyond.

- Diplomatic Engagement: Advocates should seek to initiate dialogues with BRICS member nations, emphasizing shared values, historical connections, and the potential for collaborative growth.

- Policy Formulation: Collaborative efforts should result in well-defined policies that outline the benefits, goals, and strategies for African American engagement within BRICS.

- Public Support: Garnering support from both domestic and international stakeholders, including policymakers, civil society, and business leaders, will be crucial in advancing this vision.

As the global landscape continues to shift, African Americans have a unique opportunity to redefine their position and influence. Joining BRICS offers a chance to forge new partnerships, access resources, and contribute to a more balanced and inclusive world. By advocating for membership within this alliance, African Americans can be at the forefront of change, promoting their interests while championing equality, justice, and prosperity on a global scale.

Lawsuit Targeting Fearless Fund Part of a Disturbing Trend

Recent events have unveiled a deeply unsettling truth within the intricate fabric of American society and law: the once-revered cloak of justice is marred by visible signs of distress. At the forefront of this narrative, a legal battle unfolds that sheds light on the broader challenges facing marginalized communities.

On one side, several financial institutions have perpetuated fraud, leading to economic ruin for many, and some in the industry have condoned the harmful practice of redlining, disproportionately impacting the Black community. On the other side, even modest strides toward equality encounter seemingly insurmountable obstacles.

This complex tale of systemic inequality pivots around a recent legal clash. The American Alliance for Equal Rights (AAER), founded by a conservative activist instrumental in the U.S. Supreme Court’s June decision rejecting affirmative action, has taken aim at an Atlanta-based venture capital fund: the Fearless Fund. This fund stands as a vital force in supporting Black women-owned small businesses, providing them a platform for growth and empowerment. Notably, the Fearless Fund has also backed African American-owned enterprises like Capway, as they venture into the competitive fintech space.

AAER’s lawsuit against the Fearless Fund alleges that its exclusive support for Black women-owned small businesses breaches Section 1981 of the Civil Rights Act of 1866. This legal confrontation serves as a poignant reminder of the enduring legacy of systemic racism, intensified by the actions of influential financial giants.

The story of systemic injustice takes us back to pivotal moments of financial reckoning. In April 2003, major U.S. commercial and investment banks faced conviction for abetting fraudulent business practices and schemes. The consequences were a paltry $1.4 billion fine imposed by the U.S. Securities and Exchange Commission — a trivial penalty that allowed unethical conduct to thrive unabated. This stark contrast is highlighted as Black individuals continue to bear disproportionate penalties for minor transgressions, as exemplified painfully by the case of George Floyd. The haunting reverberations of the $19 trillion economic catastrophe triggered by the 2008 financial crisis, documented meticulously by the U.S. Department of the Treasury, serve as a stark reminder of the dire consequences stemming from unchecked greed and corruption.

The disheartening pattern persisted into 2012 with the LIBOR scandal. Here, financial giants manipulated a crucial interest rate to their advantage, leaving a trail of damage, including negative impacts on the $250 trillion-dollar derivatives market, in their wake. This is a grim testament to the enduring presence of unaddressed misconduct.

As we reflect on this disconcerting narrative, a jarring incongruity becomes apparent. Why does AAER target a modest venture capital fund supporting Black women, while predominantly white institutions perpetuate systemic financial turmoil without bearing equivalent consequences? This stark divergence forces us to scrutinize the very foundations of our economic system and the systemic biases that persist.

In the midst of this tumultuous backdrop, a pressing question demands answers: Why this specific legal battle, and why now? Our strategic course moving forward may not be fully detailed here, but one thing is clear: In the face of potential political pushback, retreating is not an option. The undeniable influence of race and gender on economic disparities necessitates an authentic and courageous approach. Advancing both moral and business progress demand unwavering commitment.

As the threads of this legal confrontation intersect and intertwine, an opportunity emerges to untangle the knots of inequity and prejudice. Only through collective determination can we hope to mend the frayed edges of our cherished cloak, weaving anew a revitalized fabric of equality, liberty and justice for all.

Published in the BankThink section of the American Banker Newspaper on August 24, 2023, 10:00 a.m. EDT. https://www.americanbanker.com/opinion/the-lawsuit-targeting-the-fearless-fund-is-part-of-a-disturbing-trend

S&P Joins Moody’s In Cutting Ratings for U.S. Banks

On August 22, two weeks after Moody’s Investors Service sent shockwaves through the financial sector by downgrading numerous U.S. banks, S&P Global Ratings has taken a similar stance, citing a challenging environment for lenders, downgrading banks including KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp., and Associated Banc-Corp. The move comes as a stark reminder of the complex pressures facing the banking industry in today’s economic landscape.

S&P attributed these downgrades to the confluence of factors such as rising interest rates and shifts in deposit patterns across the industry.

Adding to the downgrades, the agency revised its outlook for River City Bank and S&T Bank to negative, underscoring the broader concerns it shares regarding the industry. Furthermore, S&P’s assessment of Zions Bancorp remains pessimistic even after their review, reflecting the challenges faced by this specific institution.

This recent move by S&P echoes the actions of Moody’s earlier this month, when it cut credit ratings for ten U.S. banks and cautioned about the possibility of further downgrades as part of a comprehensive analysis of mounting industry pressures. The synchronicity between the actions of these two major credit rating agencies underscores the systemic issues that banks are grappling with, signaling a broader concern within the financial sector.

Additionally, it is worth noting that 11 days before Moody’s initiated its ratings cuts, MinorityBank.com commented on a report that one of the largest black-led banks in America had begun a national search for a new CEO. The announcement, made on August 11, 2023, sparked discussions about the unique challenges that the incoming CEO might face in an evolving banking landscape.

We highlighted some of the pressing issues that the new Carver CEO will confront. These include the disruptive influence of artificial intelligence on banking operations, as well as the potential implementation of new capital rules that could necessitate immediate capital raising.

We also emphasized the new CEO’s responsibility to navigate the possible elimination of all minority business programs, a development that might stem from debates around affirmative action programs. The outcome of these discussions could substantially impact the business foundation of the black-led bank, adding an additional layer of complexity to the CEO’s role.

We speculated that a younger leader might be better equipped to tackle these multifaceted challenges, although this perspective challenges traditional norms within the banking industry.

In conclusion, the recent downgrades by both Moody’s and S&P Global Ratings highlight the turbulence faced by U.S. banks as they navigate through a complex web of economic, regulatory, and societal challenges. As the financial sector continues to evolve, the role of leadership in banks, particularly those facing unique circumstances like Black-led institutions, takes on new dimensions of complexity and responsibility. The decisions made by these institutions’ leaders will not only shape the banks’ futures but also influence the trajectory of the entire industry.

ONE OF THE LARGEST BLACK-LED BANKS IN AMERICA LAUNCHES NATIONAL SEARCH FOR CEO

According to MinorityBank.com banking analyst William Michael Cunningham, Carver’s new CEO will face a challenging business environment, including the impact of AI on banking and new potential capital rules that will require the CEO to raise capital immediately.

Further, he says the CEO will have to manage the impact of the potential elimination of all minority business programs due to the fallout over affirmative action programs, which could affect Carver’s business base.

“I think a younger person will be better able to deal with these issues, but this tends to go against tradition in the banking industry,” Cunningham says.

See: https://www.blackenterprise.com/carver-bancorp-launches-national-search-ceo/

HERE’S HOW BLACK BANKS ARE TAPPING INTO BANKING GIANT TO MAKE A DIFFERENCE

“Economist William Michael Cunningham, founder of MinorityBank.com, says JPMorgan Chase’s commitment shows increased attention to MDIs as part of a renewed focus on needs in the Black community. However, he says, the real test comes when the bank approaches the complex issues in the Black community like Black maternal mortality. ‘We see an opportunity for JPMorgan Chase to make loans to companies and nonprofits that are working on that issue.’ ” See: https://www.blackenterprise.com/how-black-banks-are-tapping-into-banking-giant-to-make-a-difference/

Investments in Minority Depository Institutions

To genuinely address the needs of the Black community, it is essential to be critical of JPMC’s commitment. The real test lies in how JP Morgan Chase addresses complex issues such as Black maternal mortality. Mere financial support is insufficient; substantial efforts are needed to tackle systemic problems disproportionately affecting minority communities. See: https://www.impactinvesting.online/2023/07/critical-reflection-on-jpmorgan-chases.html.

Also see: https://www.blackenterprise.com/how-black-banks-are-tapping-into-banking-giant-to-make-a-difference/