Bank Failures, 2000-2023

In recent years, Creative Investment Research has delved into various initiatives and strategies aimed at tackling the wealth gap, economic disparities and financial inclusion. In 2022, CEO William Michael Cunningham released a book examining the unique challenges faced by minority-owned businesses in accessing financial resources and support (Thriving As a Minority-Owned Business in Corporate America: Building a Pathway to Success for Minority Entrepreneurs 1st ed. Edition). In an article, we explored the development of a maternal health financing facility for the United States, which aims to improve maternal health outcomes by channeling investments into this crucial sector. Continuing our examination of initiatives to address financial inequality, another article we published in the American Banker Newspaper suggested the creation of a liquidity pool by the Federal Reserve to support Black banks, which brings us to the establishment of the Bank of Jabez, Iowa’s first Black-owned bank.

Reshonda Young, a Waterloo, Iowa native and entrepreneur, is driven to bridge the racial wealth gap through the establishment of the bank. As a community development financial institution (CDFI), this Black-owned bank will strive to empower people by providing accessible education, homeownership, and financial literacy. Young’s motivation stems from Waterloo’s identification by 24/7 Wall St., an online publication, as the worst place for Black Americans in terms of economic stability. With significant disparities in income, unemployment, and homeownership rates between Black and White residents, Young believes that a Black-owned bank can play a pivotal role in addressing these issues by lending to Black communities at higher rates than White-owned financial institutions.

In addition to her work to establish the Bank of Jabez, Young runs the Cedar Valley Black Business & Entrepreneurship Accelerator. This initiative has trained over 50 entrepreneurs and has been recognized as a model community accelerator. While the role of Black-owned banks in reducing the racial wealth gap may be significant, Young also emphasizes the responsibility of White-owned banks in addressing these disparities. She urges them to ensure accessibility, diverse representation in their workforce, and investment in programs catered to Black communities. As our society continues to grapple with financial inequality, the development of institutions like the Bank of Jabez and the implementation of inclusive banking practices represent crucial steps towards achieving economic stability for all.

According to the Wall Street Journal, Nike founder Phil Knight “are set to announce they’re donating $400 million to rebuild Portland’s Albina area, a historically Black community whose residents have experienced decades of disruption and displacement.

Rebuild Albina will be a project of the newly established 1803 Fund, a nonprofit that aims to combine elements of private investing and philanthropy. The number references the year that explorers Lewis & Clark decided to bring York, a Black frontiersman and slave, with them across the country to the Pacific.”

According to The Afro, Iowa native and entrepreneur Reshonda Young is working to open the state’s first Black-owned bank: “The Bank of Jabez, which is set to open this year, will be a community development financial institution (CDFI) and will work to prepare and empower people to create generational wealth.” For more, see:

We’ve seen a lot of changes in the Black banking sector of late. With the announcement that a Black-led investor group plans to acquire Holladay Bank & Trust in Holladay, Utah, the proposed creation of a credit union by Alpha Kappa Alpha, the nation’s oldest Black sorority, the public debut of a Black-owned bank (Adelphi Bank) in Columbus, Ohio, and the unconfirmed identification of two new Black banks (Tioga-Franklin Savings Bank in Philadelphia, PA, and Grand Bank for Savings, FSB, in Hattiesburg, Mississippi), activity in the Black banking sector has increased dramatically.

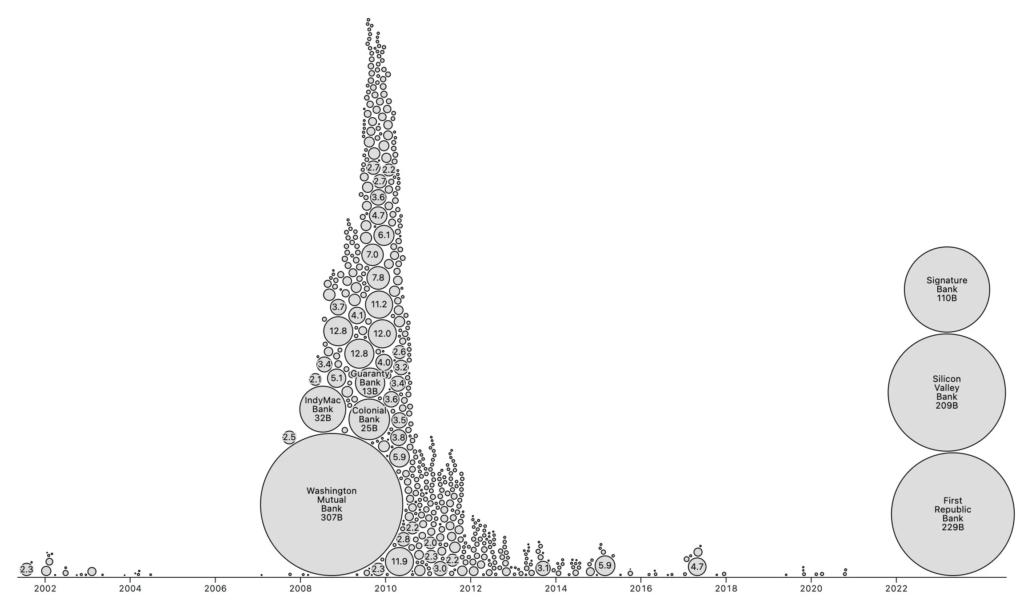

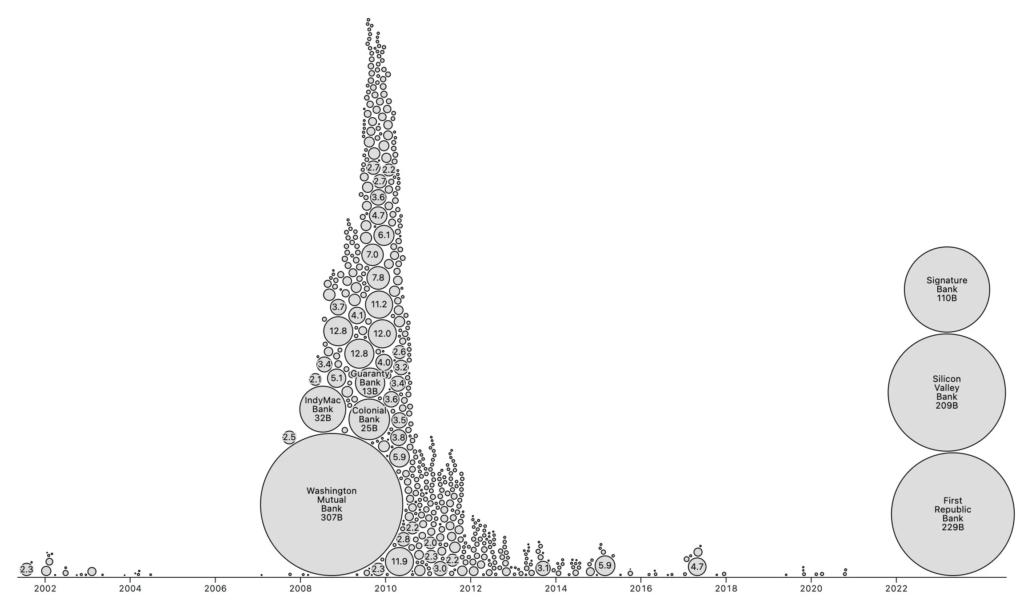

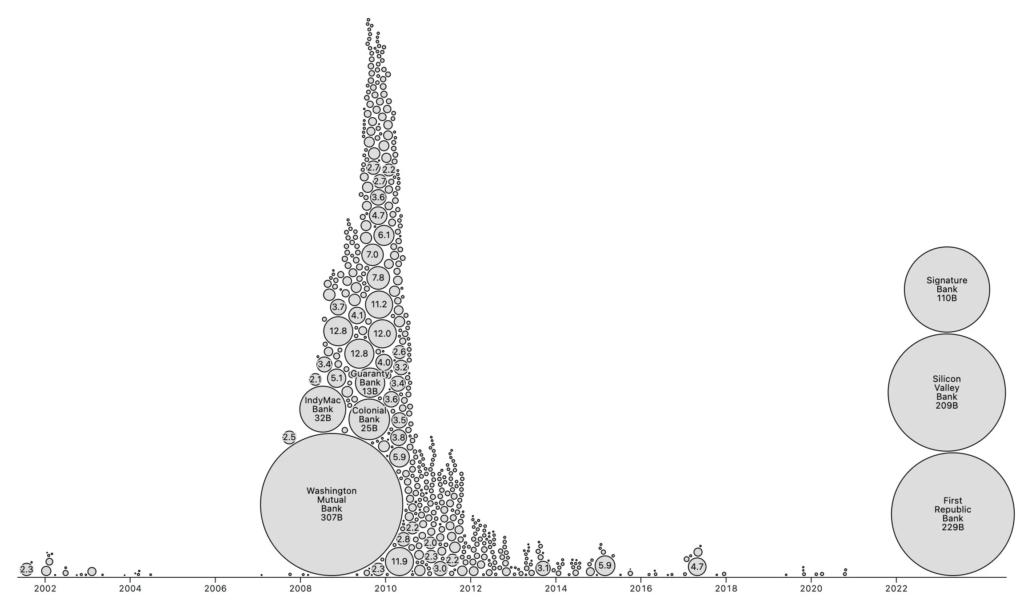

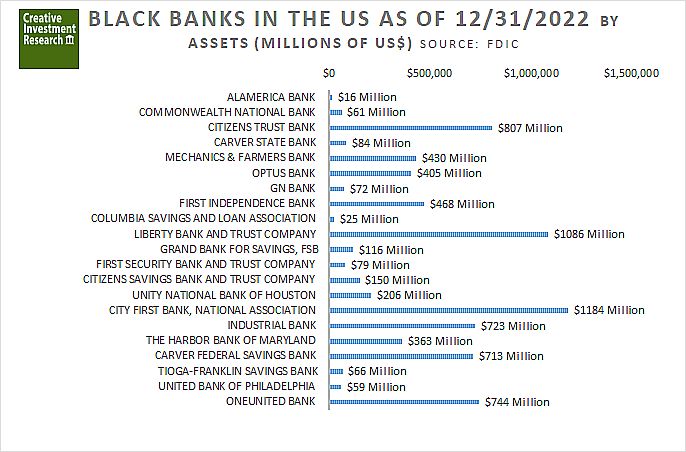

This recent growth may be the result of increased funding for Black banks following the $71 billion corporations pledged for Black Lives Matter following the George Floyd incident. Longer term, even if we confirm the African American ownership of Tioga-Franklin and of Grand Bank for Savings, there are still only 21 Black banks, representing 4 tenths of one percent of 4,706 total commercial banks and savings banks in the US as of 12/2022, according to the Federal Deposit Insurance Corporation (FDIC).

Despite these developments, as I noted in 2019, banking regulators have a history of neglecting the banking needs of the Black community, and by extension, the country. Even now, black banks remain too small and too weak to have a significant economic impact.

Given recent activity, I still think it viable for the Federal Open Market Committee (FOMC) of the Federal Reserve Board to purchase mortgage-backed securities (MBS) originated by black banks as part of open market operations. I first suggested this in 1994 at the Federal Reserve Bank of Kansas City. Since the 2006 financial crisis and 2020 pandemic, the Fed has purchased trillions in securities, helping white-owned banks, broker-dealers, insurance companies auto companies, and investment banks survive.

The solution to the Black banking impact crisis is to have the Fed, via the FOMC, create a Black bank liquidity pool totaling at least $50 billion. The pool’s focus should remain on purchasing Treasury, MBS securities and Small Business Administration (SBA) loan pools from Black ownership verified banks. To administer this new effort, I suggest having the Commerce Department’s Minority Business Development Agency help the Fed make loans to Black banks instead of simply making short and intermediate term loans to large non-minority banks, as is currently the practice of the FOMC. This would provide an estimated $450 to $500 billion dollar boost, positively impacting both the Black community and the US economy.

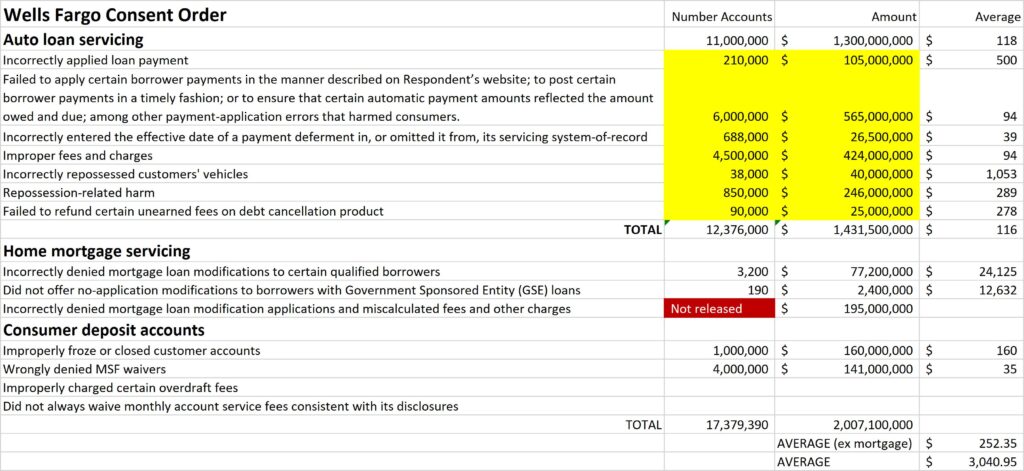

According to the Consumer Financial Protection Bureau (CFPB), Wells Fargo Bank (WFB) “incorrectly applied loan payments, erroneously imposed certain fees and charges, incorrectly repossessed customers’ vehicles, and failed to refund certain unearned fees on debt cancellation products; (ii) with respect to home mortgage servicing, incorrectly denied mortgage loan modifications to certain qualified borrowers; and (iii) with respect to consumer deposit accounts, improperly froze or closed customer accounts, improperly charged certain overdraft fees, and did not always waive monthly account service fees consistent with its disclosures.”

While CFPB claims to have fined WFB $3.7 billion, a review of the consent order released by the Agency reveals several discrepancies. The average penalty per account totaled $252.35 excluding penalties for mortgage servicing errors. These mortgage errors, while substantially higher, applied to fewer than 3.500 accounts.

According to the CFPB, 11 million auto loan accounts generated an average of $118 in penalties per loan account. CFPB indicated they have fined WFB a total of $3.7 billion. This is an average penalty of $336 per account.

See: November 20, 2018. Time to clean house at Wells Fargo. https://www.impactinvesting.online/2018/11/time-to-clean-house-at-wells-fargo.html

Waters is right to make Wells Fargo a poster child for bad practices. William Michael Cunningham. March 11, 2020. https://www.impactinvesting.online/2022/06/bankthink-waters-is-right-to-make-wells.html

Jury Hits Wells Fargo With $3.5 Million Lending Discrimination Class Action Verdict. March 24, 2011. https://www.impactinvesting.online/2011/03/jury-hits-wells-fargo-with-35-million.html

Wells Fargo sued for racially biased lending, again. August 09, 2009. https://www.impactinvesting.online/2009/08/wells-fargo-sued-for-racially-biased.html

Research firm Creative Investment Research launched an impact investing vehicle calling on the Federal Reserve to create a funding facility to reduce Black maternal mortality.

Provident Financial Services has entered a $1.3 billion deal to buy Lakeland Bancorp, which disclosed an ongoing fair lending investigation by the U.S. Justice Department.

Provident Financial Services in Iselin, New Jersey, is pursuing a $1.3 billion deal for a rival, Lakeland Bancorp, despite concerns over commercial real estate concentrations and an ongoing fair-lending investigation of Lakeland by the U.S. Department of Justice.

Lakeland disclosed the existence of the Justice Department investigation Tuesday in an 8-K Current Report filed with the Securities and Exchange Commission. Lakeland said it has “cooperated fully” and is in settlement talks. The company added that it “expects such settlement to be generally comparable to other recent DOJ fair lending settlements.”

The $10.4 billion-asset Lakeland, of Oak Ridge, New Jersey, said it could be asked to strengthen policies, procedures and training, boost community outreach and establish a mortgage subsidy fund as part of a potential resolution.

The Justice Department had not responded to a request for comment at deadline.

William Michael Cunningham, an economist and the CEO of Creative Investment Research in Washington, D.C., was more critical. The settlement Lakeland expects, he said, is “really just a fine.”

“That’s the issue with fair-lending laws,” Cunningham said. “They don’t impact a bank’s operation in the least.”

See: https://www.impactinvesting.online/2022/09/lakeland-bank-shows-signs-of-redlining.html

According to The Inflation Reduction Act and the Black Community, August 2022 report by Creative Investment Research, the figure represents spending and tax rebates that could flow back into the Black community over nine years. The nearly $740 billion health care, tax, and climate bill became a law after President Joe Biden signed it last month. Collectively, the legislation is expected to bring relief to millions of Americans, including Blacks. For more, see: https://www.blackenterprise.com/report-inflation-reduction-act-could-bring-black-americans-22-3-billion-economic-impact/