Huntington Bancshares’ Lift Local small-business lending program started small, but after four years, it’s become one of the $201 billion-asset company’s more popular product offerings.

Executives at Huntington Bancshares said the $201 billion-asset company’s 4-year-old Lift Local Business lending program has far exceeded their expectations.

The numbers tell the story. Huntington launched Lift Local in October 2020 with a $25 million lending budget. It folded the program into the ambitious five-year, $40 billion community development strategy it unveiled in June 2021, boosting its lending threshold to $100 million. Last month, Huntington disclosed Lift Local has made nearly 1,900 Small Business Administration loans totaling $133 million.

And while Huntington has made good on more than 75% of the community strategy’s $40 billion overall commitment, there appear to be no plans to wind down Lift Local. “We’re continuing to invest in the number of people that are working on the program, and some of the technology and protocols we put in place to support it,” Small Business and SBA Director Maggie Ference, said in an interview. “We’re increasing the number of community outreach events we do.”

Huntington aims Lift Local at underserved communities, minorities, women, veterans and residents in low- and moderate-income neighborhoods. According to the bank, about 40% of Lift Local loan dollars have gone to Black and Hispanic entrepreneurs. Women and veteran entrepreneurs received an equivalent amount.

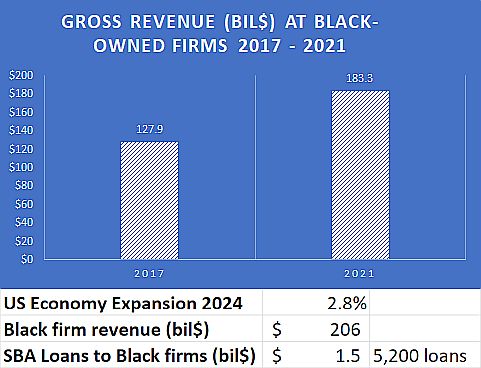

Huntington has been the nation’s No. 1 SBA 7(a) lender seven consecutive years. During SBA’s 2024 fiscal year, which ended Sept. 30, Huntington approved about 7,600 7(a) loans for $1.53 billion. More than 700 of those, totaling about $56 million, were Lift Local loans. Overall, Huntington’s average 7(a) loan size in fiscal 2024 was $202,000. The average size for Lift Local loans was approximately $71,000.

Under 7(a), SBA provides guarantees ranging from 50% to 85% on loans made by banks and other private-sector lenders.

The program has become one of Huntington’s most popular product offerings. Ference said she was quick to receive inquiries about Lift Local from groups in the Carolinas and Texas after Huntington announced its recent expansion plans. In March, the Consumer Bankers Association awarded Huntington its Joe Belew Award for its work with Lift Local.

Huntington will continue Lift Local, “not as a finite fund, but as a movement of, how do we find ways to be better partners, how do we find ways to be more to the small-business community,” Ference said.

Lift Local offers loans of $1,000 to $150,000. Along with capital, borrowers receive a bundle of other services, including financial education, a dedicated Huntington banker, and help accessing legal, accounting and other back office support services.

“We’re going to offer financial education. We’re going to offer a banker … a champion in the branch that you can come and talk to any time, that’s going to know what’s going on in your business,” Ference said. “And we’re going to give you really patient capital at a low rate along with all these other products and services.”

By all indications, the combination of credit and a broad-based support effort appears to be producing solid results. Lift Local credit losses “continue to outperform our expectations,” Ference said.

“When we originally wrote the business plans, we were looking at traditional credit metrics that would tell us this is a space that banks shouldn’t be lending in,” Ference said. “Four years later, this program is performing at levels that, frankly, it shouldn’t be, given the credit scores of some of the participants.”

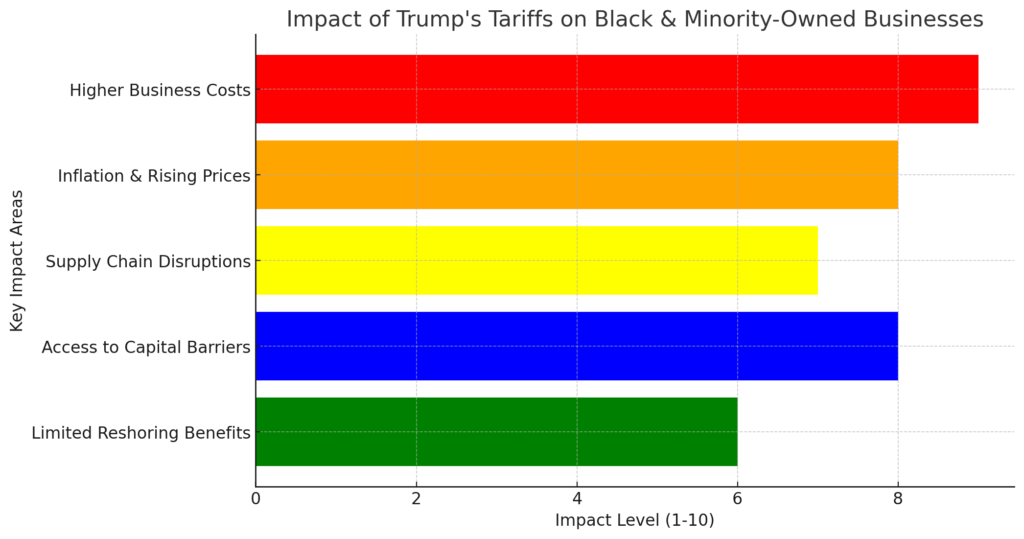

Huntington’s experience with Lift Local serves as a hint that current bank underwriting is painting an inaccurate picture of the creditworthiness of many minority borrowers, William Michael Cunningham, an economist and investment analyst who specializes in impact investing, said in an interview.

“What it’s telling you is that credit policy for small-business loans has been out-of-whack for 30 years,” Cunningham said. “Small adjustments in the lending process can have an outsize impact on performance. Banks need to take a deeper look at the people applying for credit, a deeper look at the credit procedure itself.”

Huntington’s ultimate goal is to move businesses past the need for Lift Local and similar programs. “Once we actually help them through that process … it helps legitimize them in a way that, when they come back for a second loan, they don’t need the program,”

Ference said. “They’re already scoring at a level that they could go to any bank in the country and continue to grow. What we love is that they keep doing it at Huntington.”

By John Reosti November 22, 2024, 4:05 p.m. EST