Recent developments in the global financial landscape, including the resurgence of digital currencies and the first inclusive global financial summit in Paris, have undeniably captured the attention of the finance world. These developments, which seemingly promise a new era of integration, transformation, and collaboration, hold significant implications for the future of finance and international economic dynamics. However, amidst the excitement, it is crucial to recognize the formidable obstacles that still stand in the way of realizing these lofty ambitions.

The resurgence of Bitcoin, with its staggering surge year-to-date from a low of $16,486 to a high at $31,392, is often hailed as a testament to its enduring relevance. It would, however, be remiss to overlook the inherent risks and uncertainties that accompany such a volatile digital asset. The unprecedented support from influential financial institutions like Blackrock and Fidelity adds an air of legitimacy to Bitcoin as an investment asset. Still, it is essential to approach this endorsement with caution, considering the ever-present specter of market manipulation and the regulatory challenges that continue to cast doubt on the long-term sustainability of cryptocurrencies.

Similarly, the exploration of a digital pound by the United Kingdom’s central bank, while reflective of the need to adapt to a digital future, raises fundamental questions about the stability, security, and privacy of central bank digital currencies (CBDCs). While the digital pound holds promise for greater efficiency in domestic transactions and international payments, it also poses complex regulatory and technological challenges. The Bank of England’s ambition to stay at the forefront of financial technology must grapple with concerns regarding data privacy, cybersecurity, and the potential concentration of economic power that digital currencies may exacerbate.

Moreover, the discussions surrounding a BRICS digital currency, potentially expanded to include African countries, may signal a desire to reduce reliance on dominant global currencies. It would be foolish to fail to recognize that the road to challenging the long-standing dominance of the US dollar in international trade and finance is fraught with geopolitical complexities, technical hurdles, and economic disparities. The creation of a digital currency within this influential economic bloc necessitates overcoming deeply entrenched political rivalries, differing economic priorities, and the intricate task of establishing interoperability and trust among participating nations.

Furthermore, while the recently convened Summit for a New Global Financing Pact, held in Paris on 22-23 June 2023, with its noble aim of addressing pressing global challenges and fostering international collaboration, deserves commendation, the reality remains that racism, greed, the legacy of colonialism, and the inertia derived from the status quo continue to impede meaningful progress. The world’s history is replete with instances where lofty aspirations have succumbed to self-interest and the perpetuation of existing power structures. The question of whether this summit will be a true inflection point or merely a symbolic gesture hinges on the ability to confront these deep-rooted obstacles and dismantle systemic barriers on the way to genuine financial inclusion, sustainable development, and equitable economic growth.

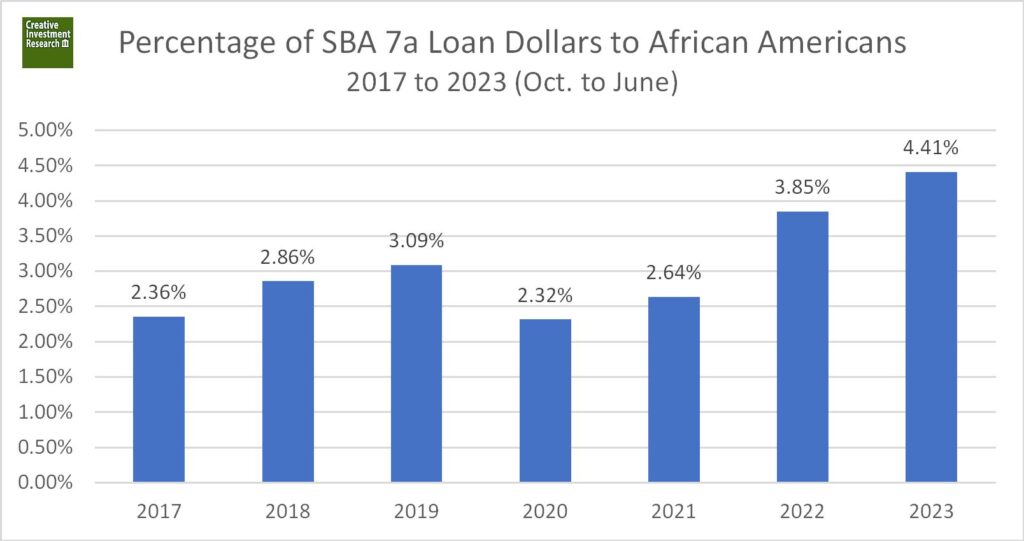

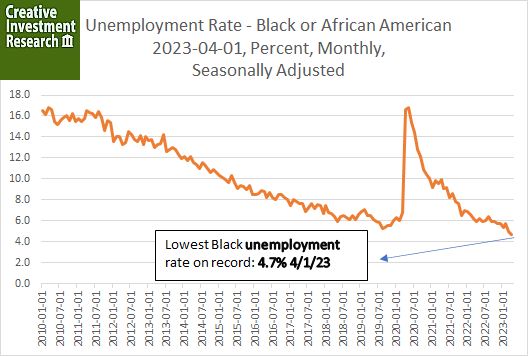

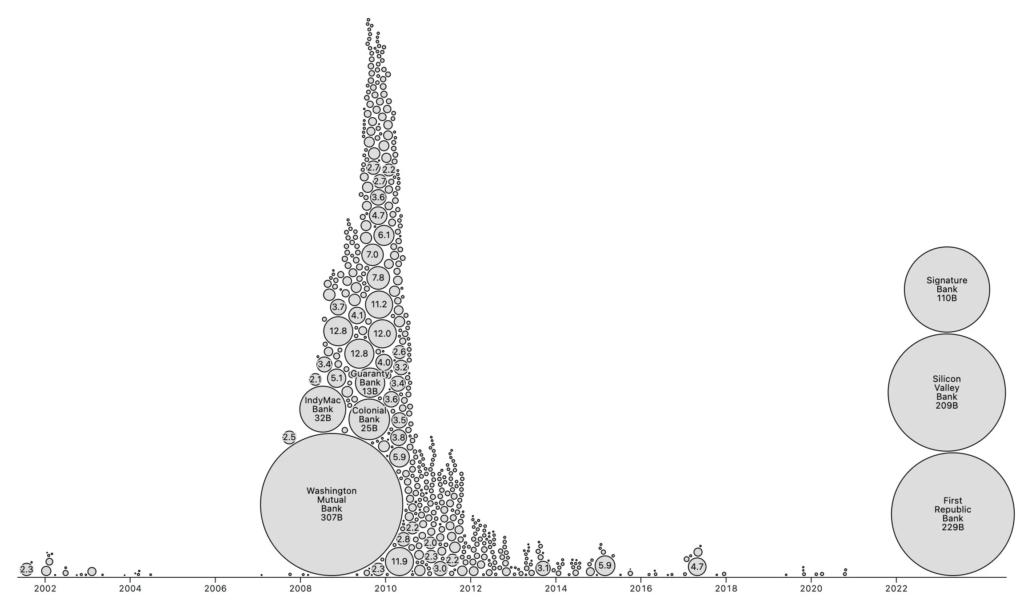

Even as the introduction of FedNow by the US Federal Reserve promises faster and more efficient payment options, the stark reality is that the benefits of such innovations often accrue disproportionately to those already in positions of privilege. The digital divide, income inequality, and the exclusion of marginalized communities remain persistent challenges. Reshaping the payment landscape and the enhancement of financial inclusivity must be accompanied by deliberate efforts to address these inequalities and ensure that the benefits of digital transformation are shared equitably across society.

In conclusion, while recent developments in the global financial landscape portend the integration of cryptocurrencies into traditional finance, the push toward digital transformation, and the imperative of international collaboration must be approached with caution. We must temper optimism with a sober understanding of the formidable challenges that lie ahead. Racism, greed, the legacy of colonialism, and the inertia derived from the status quo continue to cast a long shadow.