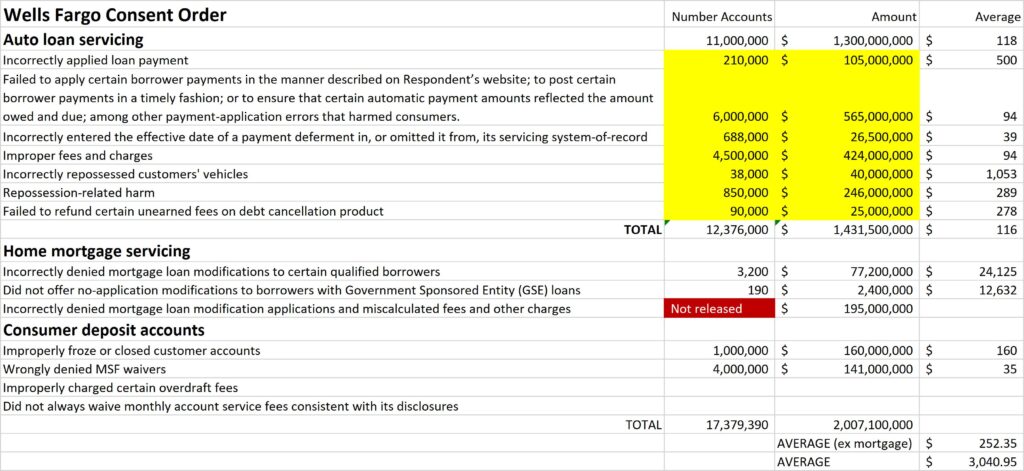

According to the Consumer Financial Protection Bureau (CFPB), Wells Fargo Bank (WFB) “incorrectly applied loan payments, erroneously imposed certain fees and charges, incorrectly repossessed customers’ vehicles, and failed to refund certain unearned fees on debt cancellation products; (ii) with respect to home mortgage servicing, incorrectly denied mortgage loan modifications to certain qualified borrowers; and (iii) with respect to consumer deposit accounts, improperly froze or closed customer accounts, improperly charged certain overdraft fees, and did not always waive monthly account service fees consistent with its disclosures.”

While CFPB claims to have fined WFB $3.7 billion, a review of the consent order released by the Agency reveals several discrepancies. The average penalty per account totaled $252.35 excluding penalties for mortgage servicing errors. These mortgage errors, while substantially higher, applied to fewer than 3.500 accounts.

According to the CFPB, 11 million auto loan accounts generated an average of $118 in penalties per loan account. CFPB indicated they have fined WFB a total of $3.7 billion. This is an average penalty of $336 per account.

See: November 20, 2018. Time to clean house at Wells Fargo. https://www.impactinvesting.online/2018/11/time-to-clean-house-at-wells-fargo.html

Waters is right to make Wells Fargo a poster child for bad practices. William Michael Cunningham. March 11, 2020. https://www.impactinvesting.online/2022/06/bankthink-waters-is-right-to-make-wells.html

Jury Hits Wells Fargo With $3.5 Million Lending Discrimination Class Action Verdict. March 24, 2011. https://www.impactinvesting.online/2011/03/jury-hits-wells-fargo-with-35-million.html

Wells Fargo sued for racially biased lending, again. August 09, 2009. https://www.impactinvesting.online/2009/08/wells-fargo-sued-for-racially-biased.html