In recent years, Creative Investment Research has delved into various initiatives and strategies aimed at tackling the wealth gap, economic disparities and financial inclusion. In 2022, CEO William Michael Cunningham released a book examining the unique challenges faced by minority-owned businesses in accessing financial resources and support (Thriving As a Minority-Owned Business in Corporate America: Building a Pathway to Success for Minority Entrepreneurs 1st ed. Edition). In an article, we explored the development of a maternal health financing facility for the United States, which aims to improve maternal health outcomes by channeling investments into this crucial sector. Continuing our examination of initiatives to address financial inequality, another article we published in the American Banker Newspaper suggested the creation of a liquidity pool by the Federal Reserve to support Black banks, which brings us to the establishment of the Bank of Jabez, Iowa’s first Black-owned bank.

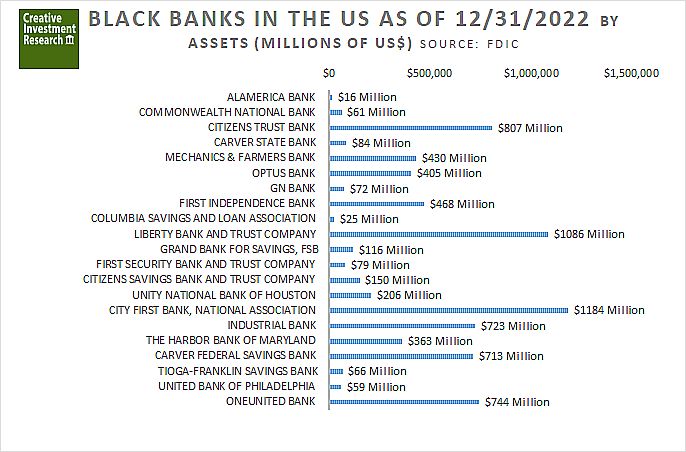

Reshonda Young, a Waterloo, Iowa native and entrepreneur, is driven to bridge the racial wealth gap through the establishment of the bank. As a community development financial institution (CDFI), this Black-owned bank will strive to empower people by providing accessible education, homeownership, and financial literacy. Young’s motivation stems from Waterloo’s identification by 24/7 Wall St., an online publication, as the worst place for Black Americans in terms of economic stability. With significant disparities in income, unemployment, and homeownership rates between Black and White residents, Young believes that a Black-owned bank can play a pivotal role in addressing these issues by lending to Black communities at higher rates than White-owned financial institutions.

In addition to her work to establish the Bank of Jabez, Young runs the Cedar Valley Black Business & Entrepreneurship Accelerator. This initiative has trained over 50 entrepreneurs and has been recognized as a model community accelerator. While the role of Black-owned banks in reducing the racial wealth gap may be significant, Young also emphasizes the responsibility of White-owned banks in addressing these disparities. She urges them to ensure accessibility, diverse representation in their workforce, and investment in programs catered to Black communities. As our society continues to grapple with financial inequality, the development of institutions like the Bank of Jabez and the implementation of inclusive banking practices represent crucial steps towards achieving economic stability for all.